Christmas tax saving tips USA becomes one of the most searched topics every December—and it’s not random.

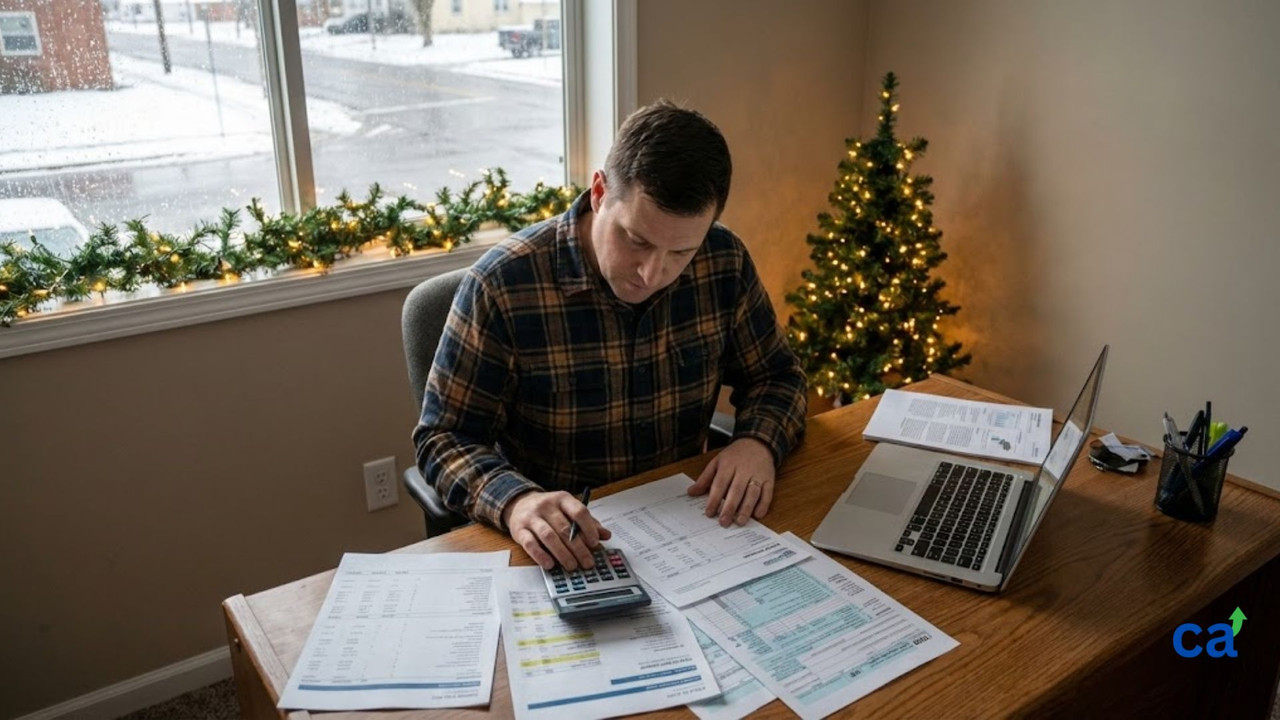

For most small business owners, December is hectic. Sales targets, pending invoices, employee holidays, and year-end pressure all collide at once. Taxes usually get postponed with the thought, “I’ll handle it during filing season.”

That delay often costs money.

The last few weeks before December 31, 2025, quietly decide how much tax a business will pay for the entire year. With the right timing, Christmas can turn into the most effective tax-planning window of 2025.

Why Christmas Tax Saving Tips USA Matter for Year-End Planning

Many tax benefits depend on when you act, not just what you plan.

December still allows businesses to:

- Adjust expenses legally

- Claim deductions before deadlines

- Clean up accounting records

- Improve cash flow for 2026

This is exactly why year end tax planning USA spikes during Christmas. Once January begins, many of these options simply disappear.

Christmas Tax Saving Tips USA: Business Expenses You Can Deduct

Not every Christmas expense is personal. Several holiday-related costs qualify as business deductions when used correctly.

Common Deductible Christmas Expenses

| Expense Type | Deductible |

|---|---|

| Office Christmas decorations | Yes |

| Employee holiday gifts | Yes (within IRS limits) |

| Staff Christmas party | Yes |

| Client gifts | Limited |

| Personal shopping | No |

Always keep receipts and clearly note the business purpose. This simple habit avoids unnecessary tax issues later.

Buy Business Equipment Before December 31

One of the most effective christmas tax saving tips USA businesses use is purchasing required equipment before the year ends.

Eligible purchases may include:

- Laptops and computers

- Office furniture

- Printers and scanners

- Business software subscriptions

Under Section 179, many of these costs can be deducted in the same tax year, depending on how your business is structured.

Prepay Expenses to Reduce 2025 Taxable Income

If certain expenses are unavoidable in early 2026, paying them before December 31 can reduce taxable income for 2025.

Examples include:

- Office rent

- Insurance premiums

- Software renewals

- Professional service fees

This strategy doesn’t create fake deductions—it simply shifts timing, which often makes a real difference.

Use Employee Bonuses Strategically Before Year-End

Employee bonuses are not only motivational; they’re also deductible business expenses.

Bonuses may include:

- Cash bonuses

- Gift cards

- Performance-based incentives

To qualify for 2025 deductions, bonuses must be paid before December 31, 2025. Miss that date, and the benefit moves to next year.

Write Off Bad Debts Before Closing the Year

Unpaid invoices should not be ignored.

If income was reported earlier but is now unlikely to be collected, it may qualify as a bad debt write-off. Reviewing receivables is an important part of small business tax tips for 2025, especially for service-based businesses.

Quick Comparison: Year-End Tax Saving Options

| Strategy | Impact | Effort |

|---|---|---|

| Expense deductions | High | Easy |

| Equipment purchases | High | Medium |

| Prepaid expenses | Medium | Easy |

| Employee bonuses | Medium | Easy |

| Bad debt write-offs | Medium | Medium |

Don’t Forget State-Level Tax Benefits

Federal taxes are only part of the equation.

Many states offer:

- Small business credits

- Local deductions

- Industry-specific incentives

Ignoring state-level benefits can mean leaving money unclaimed.

Helpful External Resource

For official guidance, refer to the IRS Small Business Tax Guide:

👉 https://www.irs.gov/businesses/small-businesses-self-employed

Common Christmas Tax Mistakes Small Businesses Make

- Mixing personal and business expenses

- Losing receipts

- Waiting until January to act

- Assuming tax filing will fix everything

Most tax problems come from delay, not from doing something wrong.

Closing Thought

Good tax planning rarely feels exciting in December. It feels inconvenient.

But businesses that quietly apply christmas tax saving tips USA owners rely on every year usually start January with clarity instead of stress. Handled properly, December 2025 can set up a calmer and financially stronger 2026.

🔗 Internal Links

Professional accounting and tax planning services:

https://cessassociates.com/

Online tax and GST calculator (year-end estimation):

https://cessassociates.com/gst-calculator/