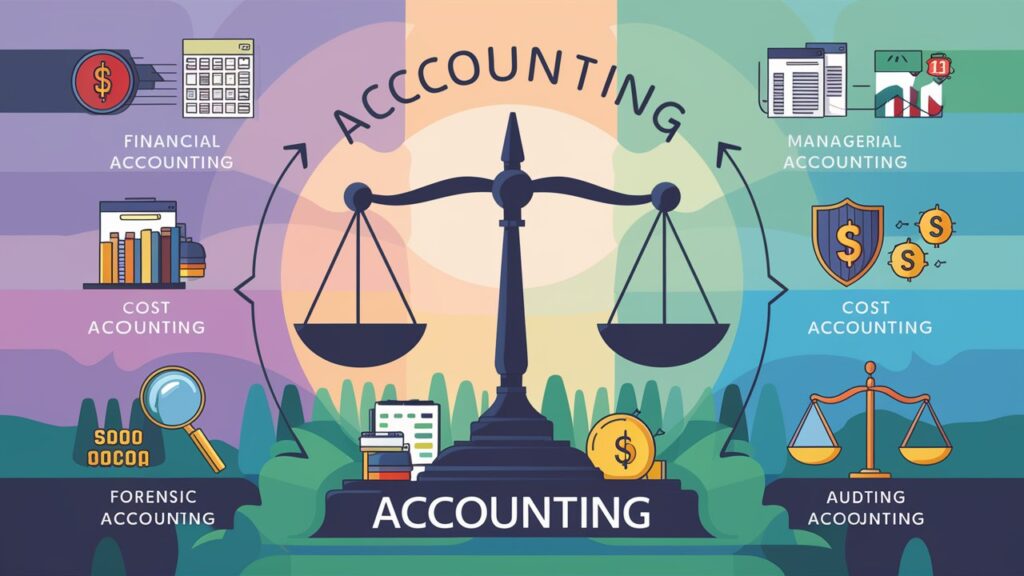

Accounting is often perceived as a straightforward field focused solely on crunching numbers and balancing books. However, it encompasses a wide range of disciplines, each serving a unique purpose in financial management and decision-making. This guide delves into the diverse how many types of accounting, offering a comprehensive overview to help you understand their roles and applications. Whether you’re a student, a professional, or simply curious, this exploration of accounting categories will enhance your knowledge and appreciation of this vital field.

Introduction to Types of Accounting

Understanding the different types of accounting is crucial for anyone involved in finance or business. Accounting isn’t just about keeping records; it’s about providing insights that drive business strategies and ensure compliance with financial regulations. The diversity in accounting practices caters to various needs, from individual financial planning to complex corporate financial reporting.

Financial Accounting

Financial accounting is perhaps the most recognized form of accounting. It involves the preparation of financial statements—balance sheets, income statements, and cash flow statements—that summarize a company’s financial performance over a specific period. These statements are essential for stakeholders, including investors, creditors, and regulatory bodies, who rely on them to make informed decisions.

Financial accounting adheres to established principles, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensuring consistency and transparency in financial reporting. This standardization helps maintain trust in financial markets and supports accurate comparisons between different entities.

Managerial Accounting

Managerial accounting, also known as management accounting, focuses on providing information to a company’s internal management team. Unlike financial accounting, which looks at the company as a whole, managerial accounting provides detailed insights into specific parts of the business, such as departments, products, or services.

This type of accounting is instrumental in budgeting, forecasting, and performance evaluation. It helps managers make informed decisions about operations, pricing, and investment strategies. Techniques such as cost-benefit analysis, variance analysis, and activity-based costing are commonly used in managerial accounting to assess efficiency and profitability.

Cost Accounting

Closely related to managerial accounting, cost accounting zeroes in on calculating the cost of producing goods or services. It involves tracking all expenses associated with production, including raw materials, labor, and overhead costs. By analyzing these costs, businesses can set appropriate prices, control expenses, and improve profitability.

Cost accounting is particularly crucial in manufacturing, where understanding the cost structure can lead to more efficient production methods and better financial outcomes. Methods like job costing, process costing, and standard costing are employed to determine accurate cost estimates and facilitate strategic decision-making.

Tax Accounting

Tax accounting specializes in preparing tax returns and planning for future tax obligations. This type of accounting requires a thorough understanding of tax laws and regulations, which vary significantly between jurisdictions. Tax accountants work to ensure compliance with these laws while minimizing tax liabilities through strategic planning.

Tax accounting involves more than just filing annual tax returns. It includes advising businesses and individuals on tax strategies, such as deductions, credits, and incentives, which can significantly impact financial outcomes. Staying updated with changes in tax legislation is crucial for tax accountants to provide accurate and beneficial advice.

Auditing

Auditing is a specialized area of accounting focused on verifying the accuracy and validity of financial information. Auditors examine financial statements and underlying records to ensure they are free from material misstatements and comply with accounting standards and regulations.

Auditing can be internal or external. Internal auditors work within an organization to assess risk management, control systems, and governance processes. External auditors, typically from independent firms, provide an objective evaluation of financial statements, offering assurance to stakeholders about the accuracy and reliability of the financial information presented.

Forensic Accounting

Forensic accounting combines accounting, auditing, and investigative skills to examine financial records for signs of fraud, embezzlement, or other financial misconduct. This type of accounting is often used in legal disputes, insurance claims, and criminal investigations.

Forensic accountants analyze complex financial transactions and reconstruct them to identify discrepancies or fraudulent activities. Their work often involves preparing detailed reports and providing expert testimony in court cases. The increasing complexity of financial crimes has made forensic accounting a growing and essential field.

Public Accounting

Public accounting firms provide a wide range of accounting services, including auditing, tax preparation, and consulting, to various clients. Public accountants work with businesses, government agencies, and individuals, offering services that help them manage their financial affairs and comply with regulatory requirements.

Public accounting is often seen as a gateway to other accounting specialties, as it provides exposure to different industries and types of accounting work. Accountants in public firms may also assist with mergers and acquisitions, financial planning, and other strategic financial services.

Government Accounting

Government accounting focuses on managing and recording the financial activities of government entities. It ensures that public funds are used effectively and transparently. Government accountants work at various levels of government—local, state, and federal—preparing budgets, managing expenditures, and auditing public funds.

This type of accounting follows specific standards, such as the Governmental Accounting Standards Board (GASB) principles, which differ from those used in private sector accounting. Government accountants play a crucial role in financial oversight and accountability, helping to maintain public trust in governmental financial practices.

Nonprofit Accounting

Nonprofit accounting addresses the unique financial reporting and management needs of nonprofit organizations. Unlike for-profit businesses, nonprofits focus on service delivery rather than profit generation. As such, their accounting practices must reflect the organization’s mission and the requirements of donors, grantors, and regulatory bodies.

Nonprofit accountants manage funds from donations, grants, and fundraising events, ensuring these funds are used according to donor restrictions and organizational goals. They prepare financial statements, such as the Statement of Financial Position and the Statement of Activities, which provide transparency and accountability to stakeholders.

Environmental Accounting

Environmental accounting, also known as green accounting, integrates environmental costs into traditional accounting practices. It involves tracking and reporting on a company’s environmental impact, such as resource use, waste generation, and pollution.

This type of accounting is increasingly important as businesses and stakeholders become more aware of environmental sustainability. Environmental accountants help companies assess the financial implications of environmental policies, investments in eco-friendly technologies, and compliance with environmental regulations. They also contribute to the development of sustainability reports, which communicate a company’s environmental performance to stakeholders.

International Accounting

International accounting deals with accounting practices and standards that vary across different countries. As globalization increases, companies operating in multiple jurisdictions must navigate diverse accounting regulations and reporting requirements.

International accountants must be knowledgeable about International Financial Reporting Standards (IFRS) and the accounting standards of specific countries where they operate. They play a key role in managing foreign currency transactions, tax planning, and financial reporting for multinational corporations.

Fiduciary Accounting

Fiduciary accounting involves managing the financial affairs of another person or entity, typically when there is a fiduciary relationship, such as a trustee-beneficiary or executor-heir relationship. This type of accounting ensures that the fiduciary manages assets according to the terms of a trust, will, or other legal arrangements.

Fiduciary accountants prepare financial reports that provide transparency and accountability, showing how funds are managed and distributed. They must adhere to legal and ethical standards, acting in the best interest of the beneficiaries.

Project Accounting

Project accounting focuses on the financial management of specific projects. It involves tracking project costs, revenues, and profitability, ensuring that projects are completed within budget and financial goals are met.

This type of accounting is particularly relevant in industries like construction, engineering, and information technology, where large, complex projects require detailed financial oversight. Project accountants work closely with project managers to monitor expenses, manage budgets, and provide financial forecasts.

Investment Accounting

Investment accounting deals with managing and recording transactions related to investment portfolios. This includes tracking investments in stocks, bonds, real estate, and other assets, as well as calculating returns, risks, and tax implications.

Investment accountants help individuals and organizations manage their investment strategies, providing insights into portfolio performance and advising on asset allocation. They also ensure compliance with relevant regulations and reporting standards.

Human Resource Accounting

Human resource accounting involves measuring and reporting the value of a company’s workforce. It considers costs related to hiring, training, and retaining employees, as well as the value that employees bring to the organization.

This type of accounting provides insights into how investments in human capital contribute to overall business success. It also helps in making decisions related to employee compensation, benefits, and development programs.

Social Accounting

Social accounting focuses on the social and ethical impacts of a company’s activities. It involves reporting on social responsibility initiatives, community engagement, and ethical practices, beyond traditional financial metrics.

Social accountants prepare reports that assess the company’s contributions to social goals, such as community development, environmental sustainability, and ethical business practices. These reports are often included in corporate social responsibility (CSR) reports, enhancing transparency and accountability.

Conclusion: Embracing the Diversity of Accounting

The field of accounting is much more diverse than many realize. Each type of accounting serves a unique purpose, catering to different aspects of financial management and decision-making. Whether you’re managing a business, planning for the future, or ensuring compliance with laws and regulations, understanding the various types of accounting is crucial.

From financial and managerial accounting to specialized areas like forensic and environmental accounting, each discipline offers valuable insights that contribute to the overall success and sustainability of organizations and individuals alike. Embracing this diversity not only enhances financial literacy but also equips stakeholders with the knowledge needed to navigate the complex financial landscape.

FAQs (How Many Types Of Accounting)

What is the primary purpose of financial accounting?

Financial accounting aims to provide a clear and standardized picture of a company’s financial performance, helping stakeholders like investors and creditors make informed decisions.

How does managerial accounting differ from financial accounting?

Managerial accounting focuses on providing detailed, internal reports for management to aid in decision-making, while financial accounting provides broader, external financial statements.

Why is cost accounting important in manufacturing?

Cost accounting helps businesses determine the costs of production, allowing them to set competitive prices and improve efficiency.

What role does a tax accountant play in a business?

Tax accountants ensure that a business complies with tax laws, helps minimize tax liabilities, and advises on tax planning strategies.

How is forensic accounting used in investigations?

Forensic accountants analyze financial records to uncover fraud or financial misconduct, often providing evidence in legal proceedings.

What is the significance of environmental accounting?

Environmental accounting tracks the financial impact of a company’s environmental activities, promoting sustainability and compliance with regulations.